Tornado.Cash Deployment Proposal On Arbitrum

Tornado.Cash keeps on spinning and is ready to settle on Arbitrum!

This article was written by ayefda & bt11ba — WUTornado team (@WUTornado)

Since the beginning of June 2021, Tornado.Cash has been continuously expanding and never stopped looking for new blockchains to spin on. So far, this journey has brought the protocol to deploy its contracts on Binance Smart Chain, Polygon, xDAI Chain & Avalanche.

It is well known that tornadoes spin better when the weather is windy. Well, it is the autumn and Tornado.Cash is ready as ever to make its next move.

To where? Arbitrum, the uprising Layer 2 solution for Ethereum.

Contribute to Tornado’s Deployment on Arbitrum

The protocol’s smart contracts are all set and ready to spin on Arbitrum. They just need help from the community to get deployed & fly with their own wings.

If you support the presence of Tornado.Cash on Arbitrum, you can participate in its deployment through the following link:

https://ceremony-arbitrum.tornado.cash/

Arbitrum in Few Words

Arbitrum One has been recently launched by Off Chain Labs as a Layer 2 solution for the Ethereum network. This blockchain allows a full access to Ethereum smart contracts & their features while acting as a second layer to relieve the traditional blockchain.

Since its inception, Arbitrum One has been very successful thanks to its high performances & low costs on transactions. Its Total Locked Value went from ~$400m in mid-September to over $2bn in a few months.

🎭 Behind The Scenes: Principle of Rollups

Frequently used, the Ethereum blockchain is victim of its own success. Its popularity has an unfortunate impact on transaction fees & execution speed. As a result, alternative solutions have naturally appeared with the intention to solve these performance and cost issues, among which Layer-2 networks.

Arbitrum One is part of those Layer-2 scaling solutions that efficiently relieve the strain on the main blockchain.

It operates under the principle of Optimistic Rollups.

We speak of rollups when, during a transaction, the actual computation & storage of the contract are made off-chain. However, the corresponding proof-of-transaction is put on-chain. Indeed, a validator posts on-chain a Rollup block summarizing into one single on-chain transaction all the actions made by the contract as well as their results.

Optimistic rollups apply a fraud proof security model to those rollups.

It means that transactions are assumed valid by default. However, they can be challenged by anyone in case a fraud is suspected. When a challenge takes place, a computation is run on the transaction to verify it. This method allows a higher number of transactions to take place while maintaining security on the network.

✈ From Ethereum to Arbitrum

Arbitrum One doesn’t have any native token. All crypto-assets that are used on Arbitrum come from the Ethereum blockchain. Without a native token, transaction costs are paid in ETH.

Therefore, to be used on Arbitrum, crypto-assets need to be bridged from the Layer 1 (L1) to the Layer 2 (L2). Off Chain Labs also offer a bridging service: Arbitrum Bridge. In principle, all tokens used on Ethereum can be bridged for Arbitrum, including ETH, ERC20 & ERC-721 tokens.

Tornado.Cash 🤝 Arbitrum

Settling on Arbitrum will allow Tornado.Cash users to take advantage of all the benefits a Layer 2 can offer, with cheaper transactions being the biggest comparative advantage.

This proposal is part of the protocol’s desire to constantly improve itself and allow more users to claim back their right to privacy. Moreover, with this deployment, Tornado.Cash will join a thriving ecosystem composed of multiple other DeFi applications.

Arbitrum Metrics 📈

- The current Total Locked Value of Arbitrum is ~$2.4bn, ranking 9th blockchain in terms of TVL according to Defi Llama.

© https://defillama.com/chain/Arbitrum

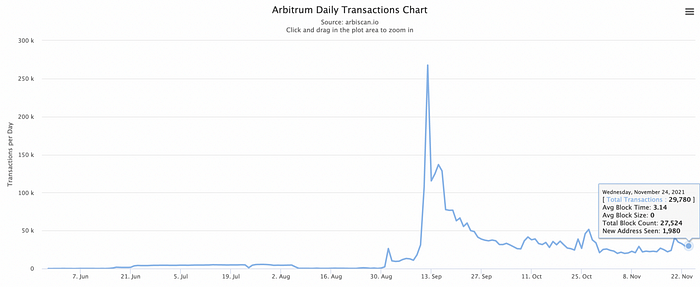

- After a peak of use in mid-September (~268k transactions), Arbitrum had between 20k & 50k daily transactions during the last two months.

© https://arbiscan.io/chart/tx

- There is over ~280k unique addresses on Arbitrum.

- According to Dune Analytics, more than 330k ETH has been bridged to be used on Arbitrum.

- As there is no native token, transactions on Arbitrum are paid for in ETH. Gas fees are extremely low compared to the Layer 1 (Ethereum).

A transaction costs ~2.5Gwei on Arbitrum (vs. ~130Gwei on the Ethereum blockchain).

Example of fees on a deposit transaction: 0.002 ETH (~$8)

Example of fees on a withdrawal transaction: 0.0018 ETH (~$7)

The link to actively participate in Tornado.Cash next step by deploying its contracts on Arbitrum is: https://ceremony-arbitrum.tornado.cash/.

This article was written by ayefda & bt11ba — WUTornado team (@WUTornado).